Where decarbonization is headed: a Q&A with Nat Bullard

Each year, climate analyst Nat Bullard releases an extensive report on the state of decarbonization. It’s an indispensable annual look at our world through data. As Bullard explains, “a coherent view of the future begins with the clearest possible view of the present.” You can read the full report here.

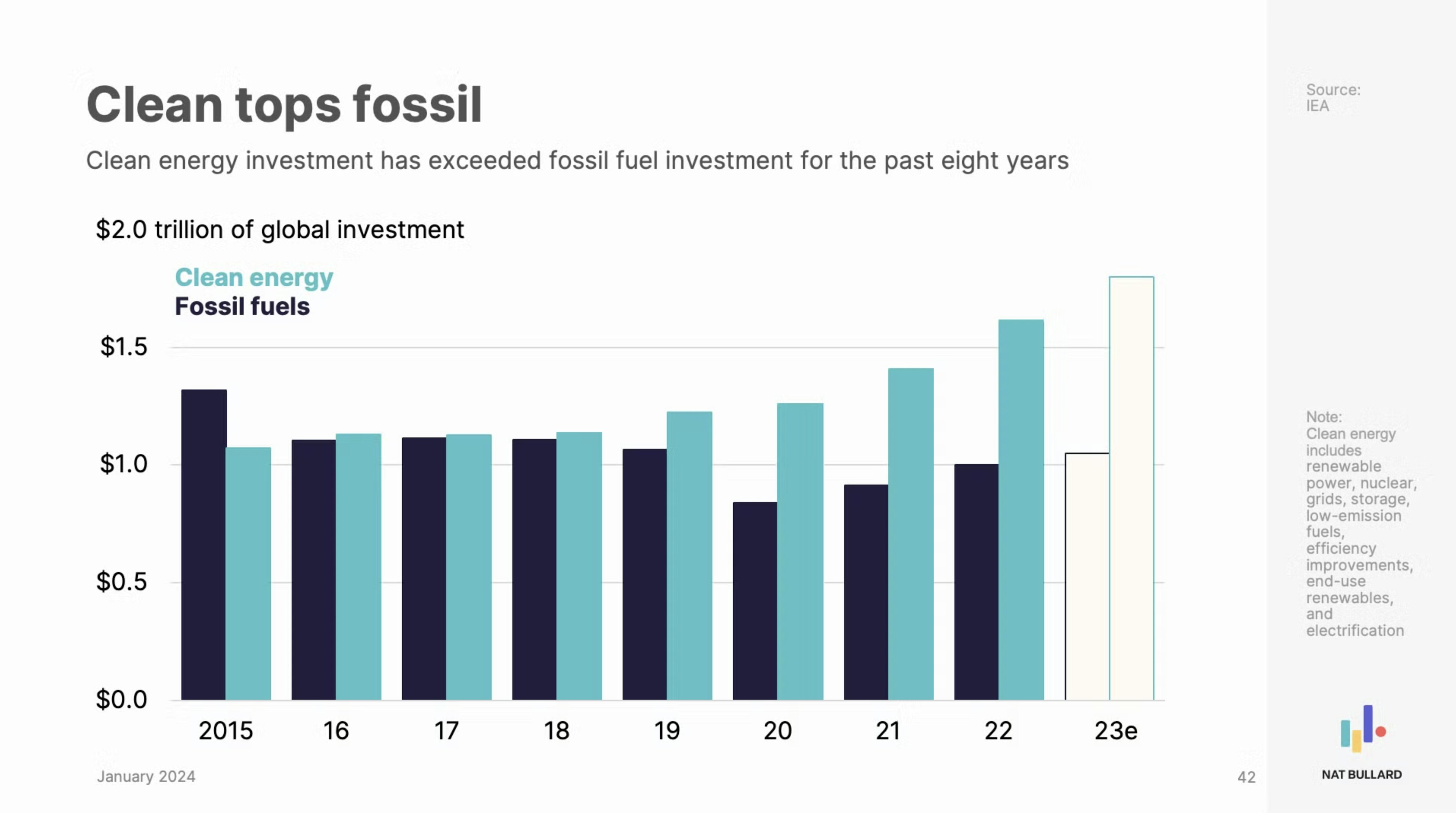

In it, you’ll find some bleak news — 2023 featured the warmest 12 months in 125,000 years — paired with some significant reasons for hope. Or at least, cautious optimism. One big finding: For almost a decade now, investments in clean energy have been exceeding those in fossil fuels — and by impressive margins in the last couple years.

Now that we’re over halfway through 2024, we wanted to check in with Bullard about where he thinks decarbonization is headed, this year and beyond. As a member of Arcadia’s advisory board, Bullard’s insights continue to inspire and inform our work to connect the clean energy future. Here’s our Q&A with Nat.

Arcadia: Your report begins with a massive warning about the state of climate change: 2023 featured the warmest 12 months in 125,000 years. But it’s also full of hopeful trends in the world of decarbonization. How would you sum up the biggest high-level takeaway of the report?

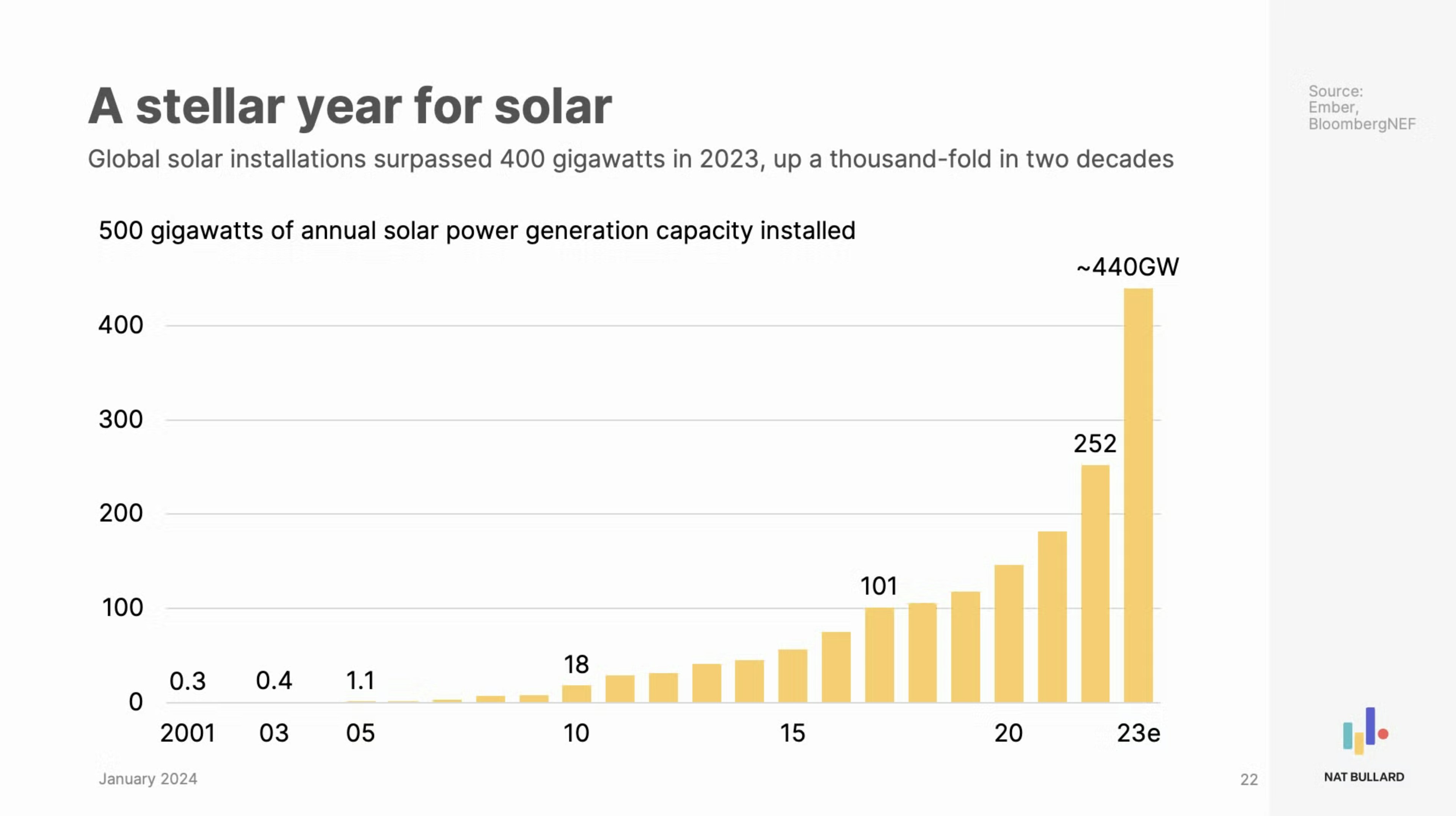

Nat: 2023 was a year of superlatives, on both the incumbent and the new sides of the climate/energy/transport/industry ledgers. It was a year of record CO2 levels, record methane levels, record surface temperatures, emissions from fossil fuel combustion, seaborne coal demand… and also a year of record decarbonization investment, and solar installation, and electric vehicle sales. I could go on and on about both sides of the ledger at length, but what is most important, to me, is that we hold both things true at once. The lagging indicators of anthropogenic climate change have never been more dire; the leading indicators of what we can do to change our trajectory have never been better.

Arcadia: What have the findings indicated to you about where we’re headed in 2024 and beyond?

Nat: The simple answer is: more of everything. We are looking at a record year for oil demand, but also another record year for solar installations, battery installations, EV sales, investment in hydrogen, and many other things. We will soon approach the point where the annual expansion of supplied clean electrons is sufficient to meet all of the growing electricity demand, and then become the only growth aspect in the electricity system, and eventually in primary energy supply.

Arcadia: Here at Arcadia, we’re building a platform that unlocks and democratizes energy data. In the past, this data had been siloed across thousands of individual utilities. Now, we’re building tools to streamline and standardize both usage data and rate data to help businesses with a wide range of use cases. How do you think this democratization of energy data can help expedite decarbonization?

Nat: Wider access to data means that more people can make better-informed decisions. I believe this is a fairly simple statement, but no less profound for being simple. We want a world where more people know more about their own activity, and use it as impetus to change what they do for the better.

Arcadia: On your interview with the Plain English podcast, host Derek Thompson described solar and storage as the “the twin pillars of the global clean energy revolution.” Your report called out that 2023 was a “stellar year for solar” and that “energy storage installations tripled.” Do you think the explosive growth of solar & storage can be maintained in 2024 and beyond?

Nat: We are in an era where the rate-determining step on expanding solar and storage is not technology, or materials, or even cost — it is capital (to some extent) and planning and permission (to a much greater extent, particularly in the US). Global solar manufacturing capacity is well ahead of what we need for a net zero path at the end of this decade, and lithium-ion battery storage manufacturing capacity is very close to that net zero marker. Making the hardware is not a limit to growth — the limit to growth is the speed with which we can move from idea to asset.

Arcadia: How do you think access to real-time, accurate utility tariff rate data could help solar & storage companies expedite their growth?

Nat: Markets work best where signals are strong, but they also work best when signals are clear. Real-time, accurate tariff data allows those who buy and sell power to better understand what the market is asking, so to speak, and give those companies a quicker, more effective way to respond with a commercial offering as well.

Arcadia: Your report showed “mixed signals” on how companies view ESG as an opportunity and as a contributor to performance. Still, with the SEC’s recently passed climate disclosure rule, more companies are preparing for compliance in the future. How do you think this conversation will evolve in 2024?

Nat: I expect the rhetoric around ESG to remain fraught for quite some time. At the same time, I expect the business imperative to become more efficient, emit less, impact the environment less, and return more capital to investors to only strengthen. Accurate data, as ever, is an asset for this constant business inquiry.

Want to learn more about Arcadia's data platform?

Get in touchJoin our newsletter

Stay updated with our latest insights, industry trends, and expert tips delivered straight to your inbox