How to get tax credits for saving on energy

Did you know you the government will reward you for being energy-conscious? It's true! You know that energy conservation is important for the environment, but the federal government also provides some financial incentives for homeowners in the form of tax credits.

When you make energy-smart decisions during home renovations and repairs, you can deduct a portion of the expense on your annual tax return. Depending on your other deductions, these tax credits can help reduce the federal taxes you have to pay. Here’s how it works:

Tax Write-Offs

The concept of residential tax savings for energy efficiency was originally part of the Energy Policy Act of 2005, which initially only applied to solar systems and fuel cells. Some of these credits expired at the end of 2016, but were renewed under the Bipartisan Budget Act of 2018, and are now retroactive for any purchases you’ve made through December 31, 2017.

You’ll be able to claim these tax credits through December 31, 2021, although each year the amount you can deduct will gradually decrease. Here are some of the items you can deduct:

Windows

Did you replace any windows, doors or skylights in your home last year? People sometimes forget that these items might be deductible because they aren’t electrical. However, newer- model, energy-efficient windows, etc. can help keep your home warmer in the winter and cooler in the summer, without expending extra energy.

Up to 10% percent of the cost of the item (not counting installation) may be claimed as a tax credit, with a maximum of $200 on windows and skylights, and $500 on doors. If you buy several new pieces, the collective tax credit would max out at $500. Note that the new windows, doors or skylights must be ENERGY STAR-certified products. You don’t have to replace all your windows, doors or skylights to qualify, nor does your purchase necessarily need to be a replacement. If you install a new window where you didn’t have one before, or in a home addition, it can also qualify for the energy-saving tax credit.

Insulation

Similarly, if you put new insulation in your home, you can claim 10% of the cost of the materials on your tax return, with a maximum credit of $500.

Biomass Stoves

If you’ve never heard of a biomass stove, it’s a home heating element that burns plant-derived fuel, such as wood, wood waste or grasses. A pellet stove, for example, is a biomass stove.

To claim your $300 tax credit for purchasing a biomass stove, it must be used for home heat or water heating, and have a thermal efficiency rating of at least 75%. Be sure to keep your copy of the Manufacturer’s Certification Statement to qualify.

Levels of tax credit rewards

Central Air Conditioning

If you buy a new ENERGY STAR certified central air conditioner you can also qualify for a $300 home improvement tax credit. It can be an additional unit or a replacement unit, but it must be central air, versus a window unit. For replacements, note that you’ll probably have to replace the device that pushes the cool air through the ducts, as well as the cooling unit itself.

Water Heaters

How about another $300 deduction on your taxes? Replace your water heater with a more energy-efficient model. For example, a solar water heater. The amount of the potential tax credit depends on the type and model of unit you get.

If you can't invest in a solar water heater, look for more efficient models of other heaters. Electric water heaters must have an energy factor of at least 2. Gas, oil or propane hot water heaters must have an energy factor of at least .82 or a thermal efficiency of at least 90%.

Renewable Energy Devices

There are even better tax credits for people who install solar and wind equipment in their home. The credit is equal to 30% of the entire cost, including installation, with no upper limit. Solar panels count, as long as they’re used for generating electricity in your home. Solar-powered water heaters count as well unless they’re for a swimming pool or hot tub.

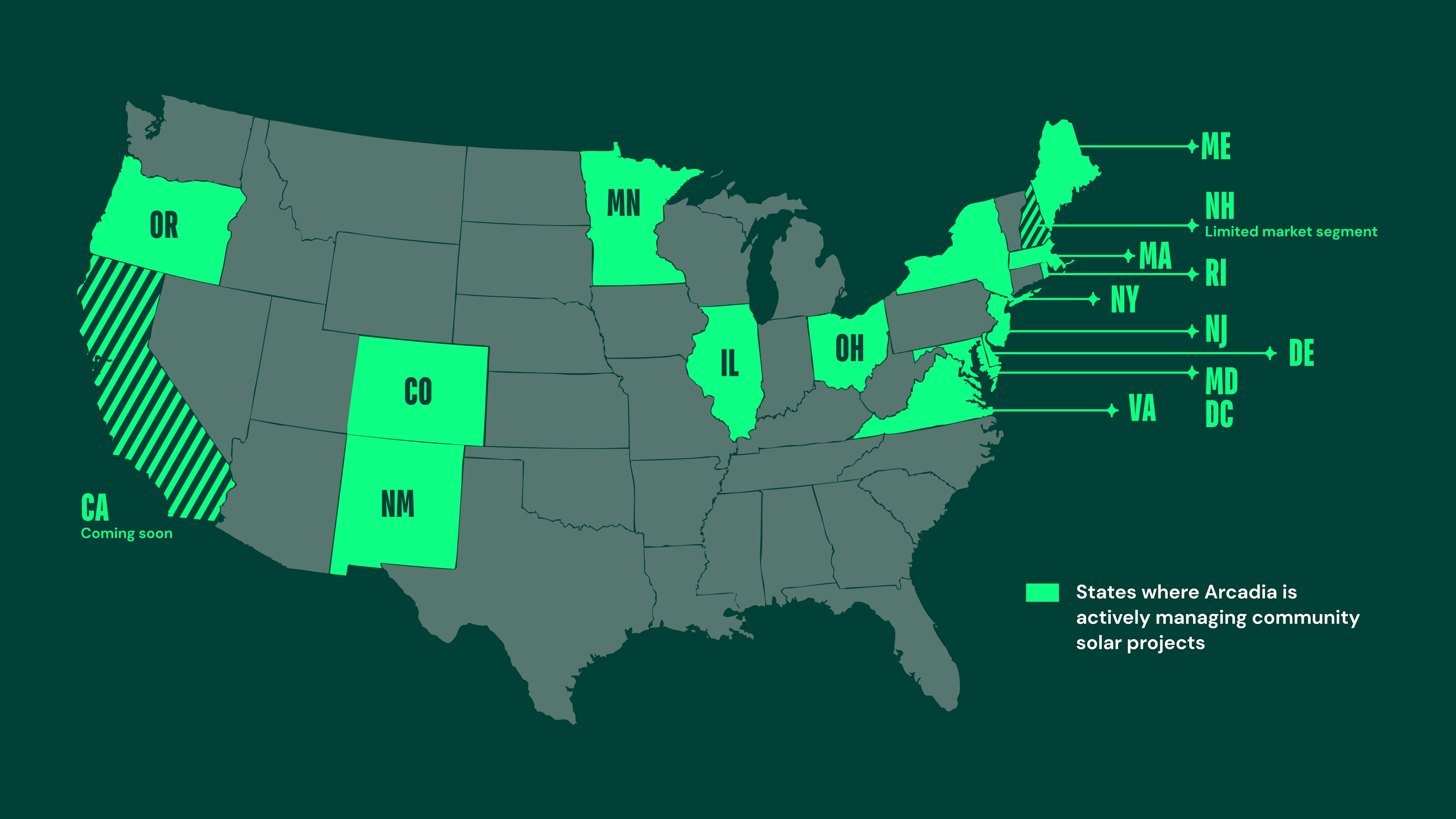

For the 92% of you who cannot, or don't want to, install solar and wind devices in your home, that's what we are here for. While you won't get access to the tax credits, you will be supporting renewable energy - and can still focus on the many additional ways to get tax credits for energy efficiency outlined in this article.

Eligibility

While renewable energy devices can earn tax credits in both your primary and secondary (vacation) homes, standard, non-renewable energy devices like windows, A/C, etc. will only count for your primary residence. It must be an existing home (not one you build new) and unfortunately, it can’t be a rental. For more eligibility requirements, click here.

Please note that like most tax laws, the terms can change. Check Energy.gov each year to see what tax credits can be claimed in your state. To claim your tax deductions for non-business/residential energy credits, use IRS Form 5695.

Energy-Smart This Year = More Money Back Next Year

Remember that the same credits available for your 2017 tax return will also apply in 2018. Keep track of all your expenditures for home repairs and improvements this year, and always choose ENERGY STAR certified products, available across more than 70 categories. You’ll save money on your utility bills, too, because these products can reduce your home energy use by up to 30%!