Our first annual Commercial Electricity Rate Report

For decades, electricity was treated as a boring line item — a predictable cost that quietly rose with inflation. That era is over.

Arcadia’s first-ever Commercial Electricity Rate Report tells a clear story: electricity costs are rising almost everywhere, but not evenly — and relying on averages is now a material financial risk for enterprise organizations.

Using Signal, Arcadia’s first-party tariff intelligence and high-accuracy bill simulation engine, we analyzed electricity costs from 2020 through 2025 across 321 tariff-building type combinations, spanning 81 utilities and five common commercial building profiles. The results reveal a market defined by volatility, structural change, and growing exposure.

Electricity rates are rising — faster than finance models assume

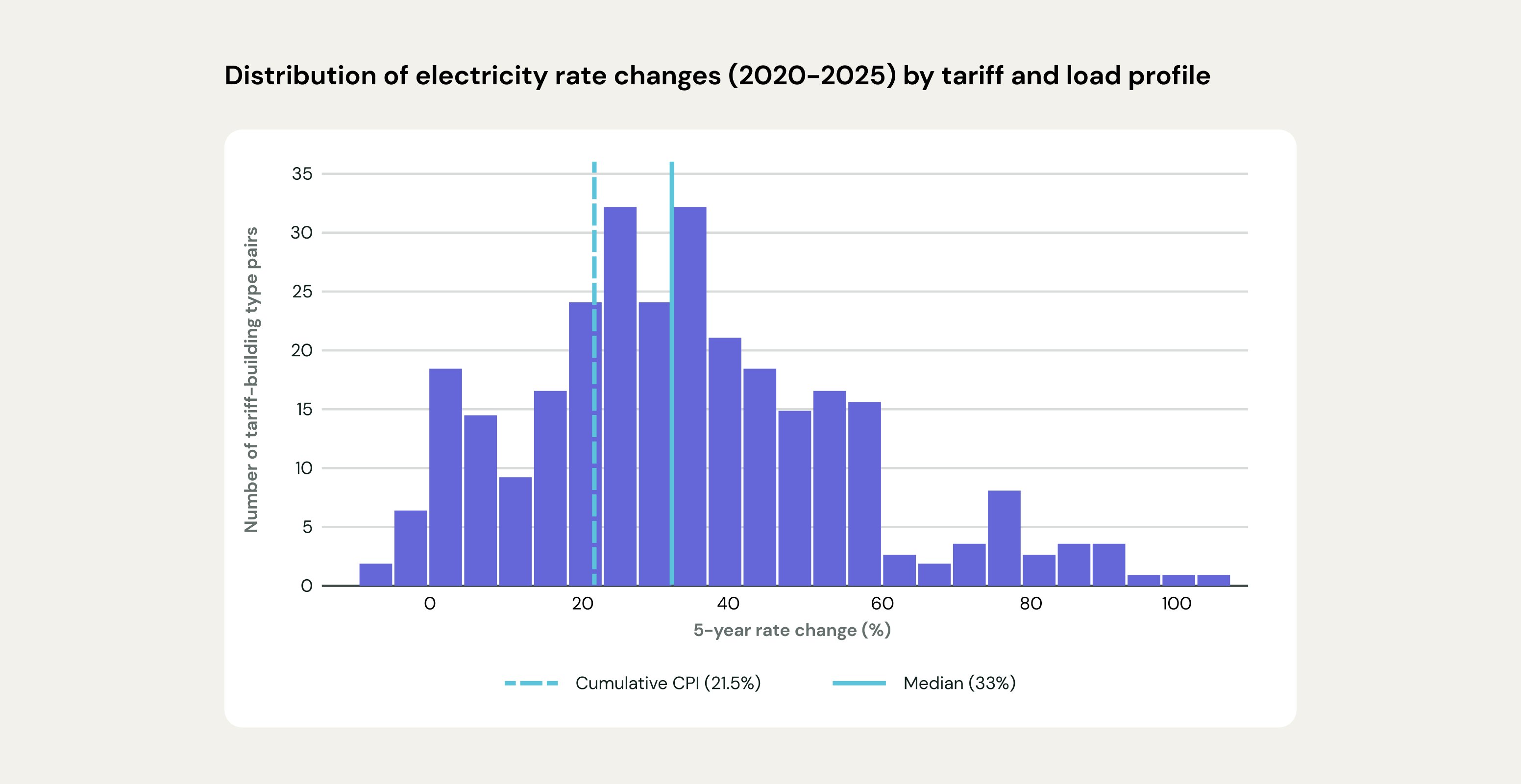

From 2020 to 2025, 97.5% of commercial facilities saw electricity rate increases, and 71% experienced increases that outpaced inflation. The median compound annual growth rate was 5.9% — nearly double the 3% escalator still baked into many corporate budgets.

But the median masks the real story. Some facilities absorbed increases approaching 100%, while others saw minimal change. Electricity inflation is no longer a smooth curve; it’s a jagged, location- and tariff-specific reality.

There’s no such thing as an “average” electricity rate

Unlike oil or natural gas, electricity pricing is dictated by hyper-local forces: regulatory decisions, grid congestion, generation mix, and — critically — how a facility uses power.

Geographic dispersion is extreme. In our data, a retail building in San Diego pays up to seven times more per kWh than a hospital in parts of Texas. Even within the same state, proximity doesn’t guarantee parity. Commercial buildings in San Diego pay 64–70% more than similar facilities just 100 miles away in Long Beach.

For enterprise portfolios, this means national- or state-level benchmarks are not just imprecise — they can deviate from actual costs by 70% or more.

Your load profile may matter more than your utility

Two buildings on the same tariff with identical annual consumption can have vastly different bills depending on when and how they use electricity.

Utilities reward steady, predictable demand and penalize “peaky” usage. In some territories, we observed price spreads of up to 74% between building types served by the same utility. Hospitals consistently benefit from high load factors, while warehouses and retail facilities often pay a premium driven by demand charges.

This distinction is critical because many traditional mitigation strategies focus only on reducing total consumption — while the fastest-growing cost driver is often peak demand.

Demand charges: The unhedged liability

For 37% of the facilities in our dataset, demand charges made up more than 30% of the total electricity bill. In extreme cases, over 70% of costs were dictated solely by peak demand.

Unlike energy supply prices, distribution demand charges can’t be hedged with a standard contract. This leaves a significant portion of enterprise energy spend exposed — particularly in markets like California, where monthly demand charges routinely reach $35–$70 per kW, far exceeding the rest of the country.

The next wave: Capacity scarcity

Looking ahead, the pressure is intensifying. Load growth from data centers, EVs, and electrification is outpacing new generation, driving capacity prices sharply higher.

In PJM alone, capacity prices are increasing 9-12x over the next several years. For a typical 1-MW commercial load, annual capacity costs will rise from roughly $10,000 in 2024 to more than $120,000 by 2027 — a structural shift that efficiency alone cannot offset.

What enterprise leaders must do now

The takeaway is not panic — it’s precision.

Enterprise leaders need to retire flat escalators, abandon averages, and understand their true cost drivers at the intersection of tariff, location, and load profile. Scenario modeling, tariff optimization, and demand-aware strategies are no longer optional; they’re essential tools for managing risk in a volatile grid.

Our full Commercial Electricity Rate Report breaks this crisis down with detailed data insights, and offers five strategic mandates for navigating what comes next.

Download the full report to see how exposed your portfolio may be — and what you can do about it

Download hereJoin our newsletter

Stay updated with our latest insights, industry trends, and expert tips delivered straight to your inbox